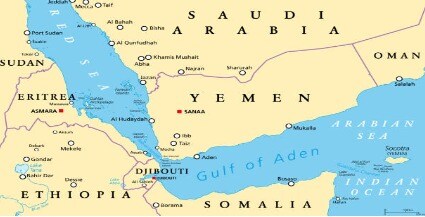

The Red Sea has long served as a vital artery for global maritime trade between Europe, Asia, and the Middle East. Located between the Horn of Africa and the Arabian Peninsula, it provides access from the Indian Ocean to the Mediterranean via the Suez Canal. About 12 percent of all global trade passes through the Suez, including nearly 10 percent of seaborne oil shipments.

The Red Sea route enables much shorter journey times between Asia and Europe compared to alternatives like sailing around the Cape of Good Hope.

Before the canal’s opening in 1869, that latter route was the standard, taking up to three months. Transit through the 120-mile Suez slashes typical Asia-to-Europe journey times to just three weeks. No wonder over 50 ships traverse the canal daily, carrying everything from oil to manufactured goods to raw commodities. Traffic through the Red Sea has steadily risen in recent decades to match expanding world trade volumes. Maintaining safe passage through this corridor is thus essential for international commerce.

Attacks by Houthi rebels

Since late November 2022, Houthi rebels in Yemen have significantly escalated attacks on commercial vessels traversing the Red Sea corridor near the Bab el-Mandeb Strait. Using bomb-laden drone boats and missiles, the Iran-backed militants have repeatedly targeted tankers and cargo ships in the narrow Gulf of Aden and the southern Red Sea. These assaults appear aimed at pressuring a Saudi-led coalition supporting Yemen’s government against Houthi forces in Yemen’s civil war.

Nearly 10% of the total seaborne global oil trade, equivalent to roughly 5 million barrels per day, flows through the Suez Canal’s pipeline and onboard tankers sailing the Red Sea. A majority of this Red Sea oil traffic heads toward Europe and North America from Gulf nations like Saudi Arabia, Iraq, Kuwait, and the UAE plus other Middle East producers. With many countries still hugely dependent on oil imports, any extended disruption along this corridor risks fuel shortages and price spikes around the world.

Role of the Red Sea as Conduit between Asia and Europe

The Red Sea shipping lane serves as the linchpin trade bridge connecting Asia with Europe. It enables much faster transit between the two continents via the Suez Canal compared to alternate routes like sailing around Africa. Before its opening, that latter journey took up to three arduous months. The Suez slashed standard journey durations to just three weeks between Asian manufacturing hubs and European markets. Red Sea access drives the cost-competitiveness critical for Asian exporters reaching Europe. European importers depend on Red Sea shipments for raw materials and finished goods from Asian trade partners. The route’s smooth functioning is thus essential for cross-regional and even global supply chains.

Alternative routes and why they are not adequate substitutes

The main alternate sea route bypassing the Red Sea and Suez Canal entails sailing around the Cape of Good Hope at Africa’s southern tip. Fuel and labour costs also rise substantially over such distances. In addition, piracy risks have resurged off Africa’s east coast, while storm exposure heightens around the Cape itself.

The journey from Asia to Europe can now add up to 10 days in transit time and thousands more kilometres in distance. Costs also escalate from higher fuel consumption, increased piracy risk premiums, and more. The pressures risk spilling over into higher consumer prices as importers pass on their added freight expenses. Port congestion also looms as vessels rerouted from the Red Sea join existing African traffic flows. The overall impacts threaten to compound existing strains on global supply chains.

Rising fuel and insurance costs for shipping companies

The lengthy Africa detours being pursued to avoid rebel threats in the Red Sea will significantly increase fuel costs for shipping companies. War risk and piracy insurance premiums also look set to rise. Combined with reduced sailing frequencies between Asia and Europe, shipping firms face a margin squeeze from soaring operating costs. Some companies could be forced out of certain routes if conditions persist.

- With higher shipping expenses ahead, importers will likely pass many extra costs on to consumers in the form of broad price increases. If transportation bottlenecks drag on, this second-order inflation effect could be substantial. The IMF estimated supply chain woes during COVID-19 added nearly 1 percentage point to global consumer inflation.

- The sudden influx of Asia-Europe traffic now having to sail around Africa could swamp port capacities. Supply chain resilience gains made over the past year could erode amid renewed congestion and bottlenecks.

- While alternate routes exist for most non-oil seaborne trade, tanker traffic is more captive to the Suez Canal pipeline’s rerouting limits. Removing over 5% of global oil shipments from markets risks supply shortfalls in importing regions like Europe and North America. Energy price volatility may also follow. Thermal coal, grain, and metals markets could face similar shipment and pricing effects given lower bulk carrier frequencies between Asia and Europe.

- The economic risks today resemble previous Suez Canal disruptions like the 1967 Arab-Israeli War or the grounding crisis. However, the impacts may prove more enduring given current rerouting challenges. Continued rebel attacks despite security efforts would further undermine shipper confidence in the Red Sea route. Full reversion anytime soon seems unlikely until the maritime security situation stabilizes.

- Extended shipping delays and cost increases arising from Asia-Europe rerouting could reverberate through intricate global supply chains. Manufacturers dependent on Chinese intermediate inputs or European sales would suffer squeeze effects. Inventory restocking would grow more difficult amid transport headaches. Supply chain resilience improvements after the pandemic may unravel, reviving shortages, logjams, and inflationary pressures.

- Higher freight expenses and reduced reliability of shipping routes tend to dampen trade volumes as firms cut back activity levels. One academic study found a 10 percent increase in shipping costs reduces long-run trade volumes by about 3 percent. Prolonged Red Sea insecurity could thus weigh on trade flows between major partners like China and the EU.

- The sourcing strategies many firms adopted by concentrating production capacity in low-cost nations like China are being tested by transport snarls in channels like the Red Sea. The crisis provides fresh impetus for companies to distribute manufacturing and sourcing across more locations to mitigate trade corridor risks.

- However, bridging the divides between Iran and Saudi Arabia will prove hugely challenging diplomatically. Without real progress in silencing arms fueling Yemen’s civil war, restoring calm in the Red Sea corridor may remain elusive.

India’s role, impacts, and response to the recent Red Sea shipping crisis

The Houthi rebel attacks on commercial vessels over the past month have directly implicated India’s interests. Defense Minister Rajnath Singh has vowed “strict action” against those responsible for the assault on MV Chem Pluto by a bomb-laden drone boat. While investigations continue into potential Iranian involvement, India remains concerned about securing maritime commerce through the Red Sea and Arabian Sea.

To contain crisis impacts, India has deployed naval destroyers, aircraft, and choppers to bolster surveillance and preventative force. Coordinating intelligence and patrol duties with the American-led “Operation Prosperity Guardian” coalition and other partners has become a priority as well. With globalized trade exposing more nations to spillovers from regional unrest, insulating India’s interests will demand proactive naval deployments, astute diplomacy, and rethinking strategic autonomy.

Conclusion

The escalating conflict involving Houthi rebels in Yemen and their attacks on merchant shipping in the Red Sea presents a multifaceted challenge. The use of advanced weaponry, including drones and anti-ship ballistic missiles, underscores the rebels’ capabilities and raises concerns about state support, particularly from Iran and possibly China. As the situation unfolds, a careful and calibrated approach is crucial to prevent further deterioration, emphasizing the urgency for a viable and achievable end state that avoids turning Yemen into a prolonged battleground.

-RIYA SINGH

MUST READ: INTERIM UNION BUDGET 2024: AN OVERVIEW